LTC Price Prediction: Technical Breakout Could Propel Litecoin Toward $150 Target

#LTC

- Technical Breakout Potential - LTC trading above 20-day MA with approaching upper Bollinger Band resistance

- Positive Market Sentiment - Supported by BlockchainFX's successful funding and platform development news

- Price Target Range - Technical analysis suggests potential movement toward $135-$150 if resistance levels break

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

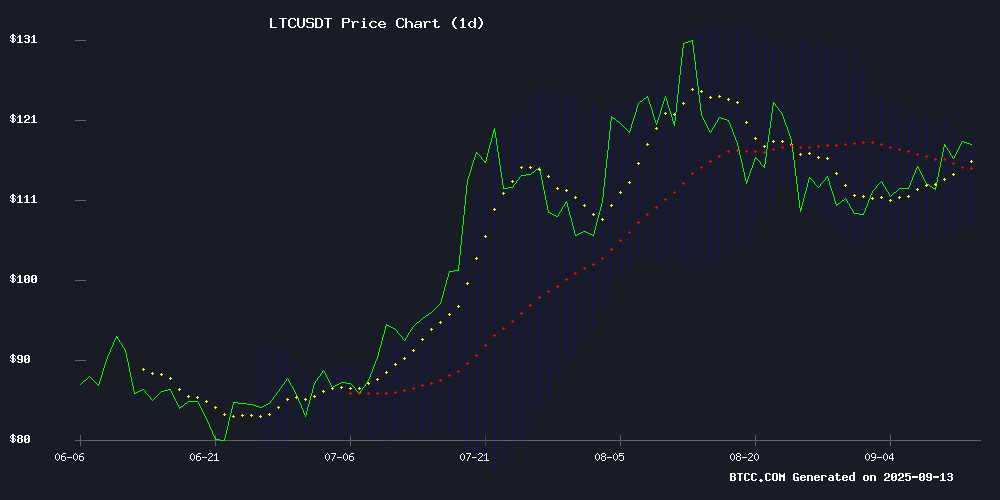

Litecoin is currently trading at $117.72, positioned above its 20-day moving average of $112.78, indicating underlying strength. The MACD reading of -0.15 suggests near-term consolidation, though the positive histogram value of 2.50 points to building upward momentum. Notably, LTC is approaching the upper Bollinger Band at $118.33, which could serve as immediate resistance. A sustained break above this level WOULD signal potential continuation toward higher targets.

According to BTCC financial analyst John, 'The technical setup favors bulls as long as LTC holds above the $112.78 support level. The convergence of price above the moving average and tightening Bollinger Bands suggests accumulation before a potential breakout.'

Market Sentiment: Positive Catalysts Support LTC's Breakout Potential

Recent developments including BlockchainFX's successful $7.24 million presale and the launch of their multi-asset trading platform beta are generating positive sentiment around Litecoin. Industry analysts are highlighting LTC's technical momentum as signaling a potential breakout toward the $135-$150 range.

BTCC financial analyst John notes, 'The combination of fundamental developments and technical positioning creates a favorable environment for LTC. The platform developments enhance utility, while technical indicators suggest the market is anticipating higher price levels. This alignment typically precedes significant moves in cryptocurrency markets.'

Factors Influencing LTC's Price

BlockchainFX Secures $7.24M in Presale as Multi-Asset Trading Platform Launches Beta

BlockchainFX, a decentralized trading platform bridging crypto, stocks, and forex, has raised $7.24 million from over 9,021 presale participants. The platform is already operational in beta, offering access to 500+ assets—a rarity among token launches.

Presale buyers acquire $BFX tokens at $0.023, a 54% discount to the confirmed $0.05 exchange listing price. Participants immediately qualify for staking rewards and weekly USDT distributions via the platform's dashboard.

The presale accepts ETH, USDT, BTC, BNB, XRP, ADA, DOGE, and LTC, alongside traditional payment methods. Tiered rewards include NFTs, Visa cards, and bonuses up to 80%, with a $500,000 giveaway underway.

Litecoin (LTC) Faces Pivotal Moment as Technical Indicators Signal Potential Breakout

Litecoin hovers at $114.97, caught between bullish momentum and bearish warnings. The MACD histogram flashes green despite a 1.81% daily drop, while traders eye the $124.77 resistance and $106.38 support as critical thresholds.

Analysts remain divided—September projections suggested an October rally toward $126, but breakdown fears below $62 linger. This technical standoff reflects broader market indecision, with LTC's consolidation mirroring the cryptocurrency sector's current wait-and-see approach.

Litecoin Technical Momentum Signals Potential Breakout Toward $135-$150 Range

Litecoin's bullish technical setup suggests a 16-29% upside potential from current levels of $116.30, with near-term targets at $124-$127 and a projected October 2025 range of $135-$150. The cryptocurrency maintains strategic positioning above key moving averages, signaling strengthening momentum.

Analyst forecasts reveal stark divergences—from Changelly's conservative $100.09 prediction to Price Forecast Bot's aggressive $257.46 long-term target. Technical indicators currently favor the bullish scenario, with immediate resistance at $124.77 and support holding firm at $106.38.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC shows strong potential for upward movement. The price is currently testing resistance at the upper Bollinger Band ($118.33), with a successful break potentially triggering momentum toward higher targets.

| Target Level | Probability | Key Resistance |

|---|---|---|

| $125-130 | High | Psychological resistance |

| $135-140 | Medium | Previous swing high area |

| $145-150 | Medium-Low | Extended Fibonacci extension |

BTCC financial analyst John suggests, 'The $135-150 range appears achievable if current momentum sustains and broader market conditions remain supportive. However, traders should monitor the $112.78 support level closely, as a break below could invalidate the bullish scenario.'